At Holt, we think long term, both for ourselves and for our clients. While we cannot perfectly predict the future, we can certainly plan for it.

In response to the changing investment environment, more and more investors are looking for alternative investments to improve the structure of their portfolios while still minimizing risk and maximizing future returns.

In order to meet these growing diversification needs, we have created a number of alternative investment funds across the risk and liquidity spectrum. These funds improve the structure of investors’ portfolios while minimizing risk and maximizing returns.

Real-Estate Fund: MEDICAL DETOX PORTFOLIO

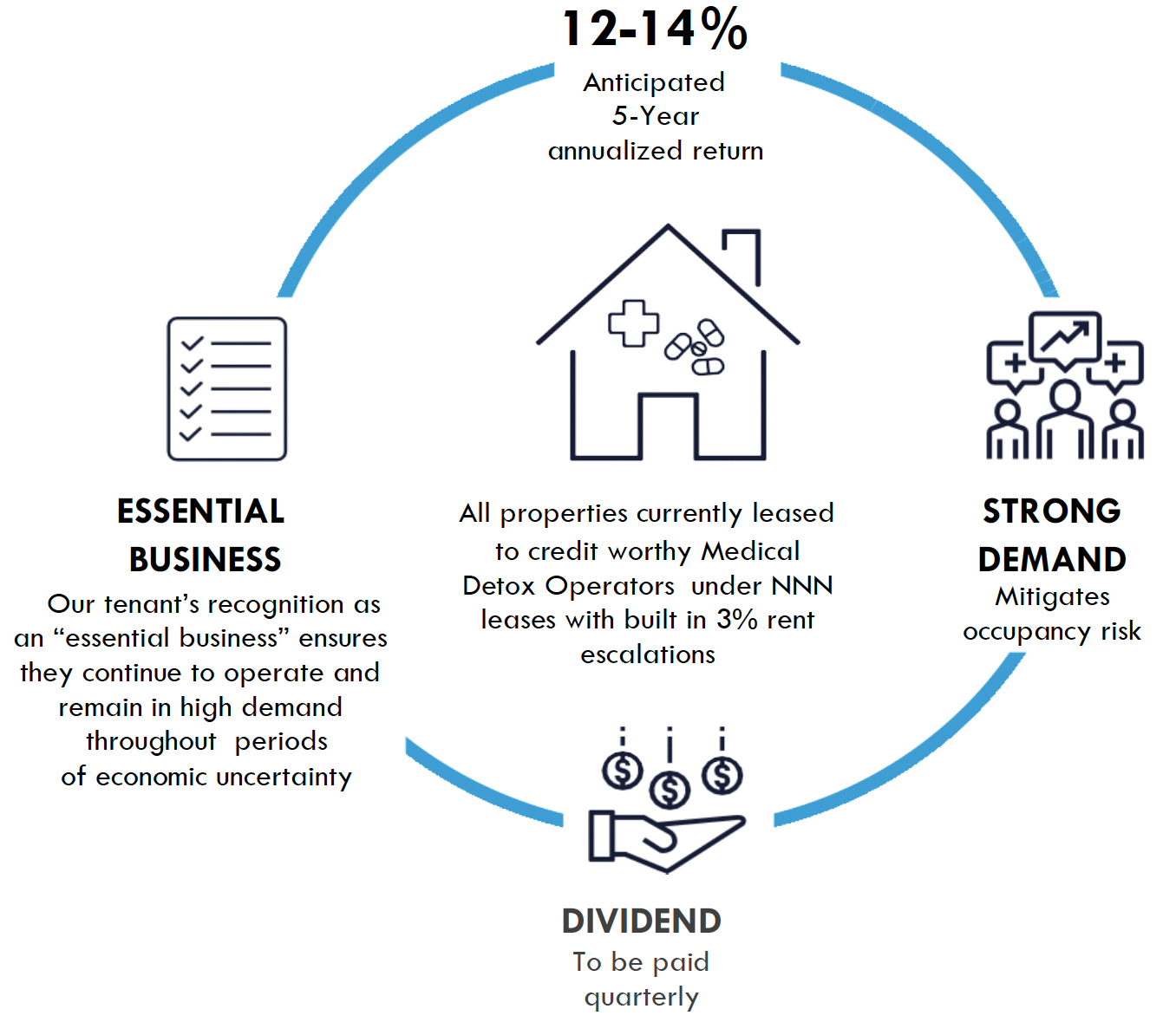

Investment Overview:

- Invests specifically in real estate within the United States that is utilized to increase the number of drug treatment programs available for those seeking a solution to opioid dependency.

- The Medical Detox Portfolio initially acquired several locations and anticipates acquiring and converting a total of 10 -15 locations that have been specifically zoned and refurbished to provide drug and alcohol medical treatment.

- Investors in the Medical Detox Portfolio receive attractive returns while providing equity necessary to acquire additional optimal locations for drug medical detox operators.

- The fund is structured as a closed-end-fund with a 5-year term with an optional 3-year extension.

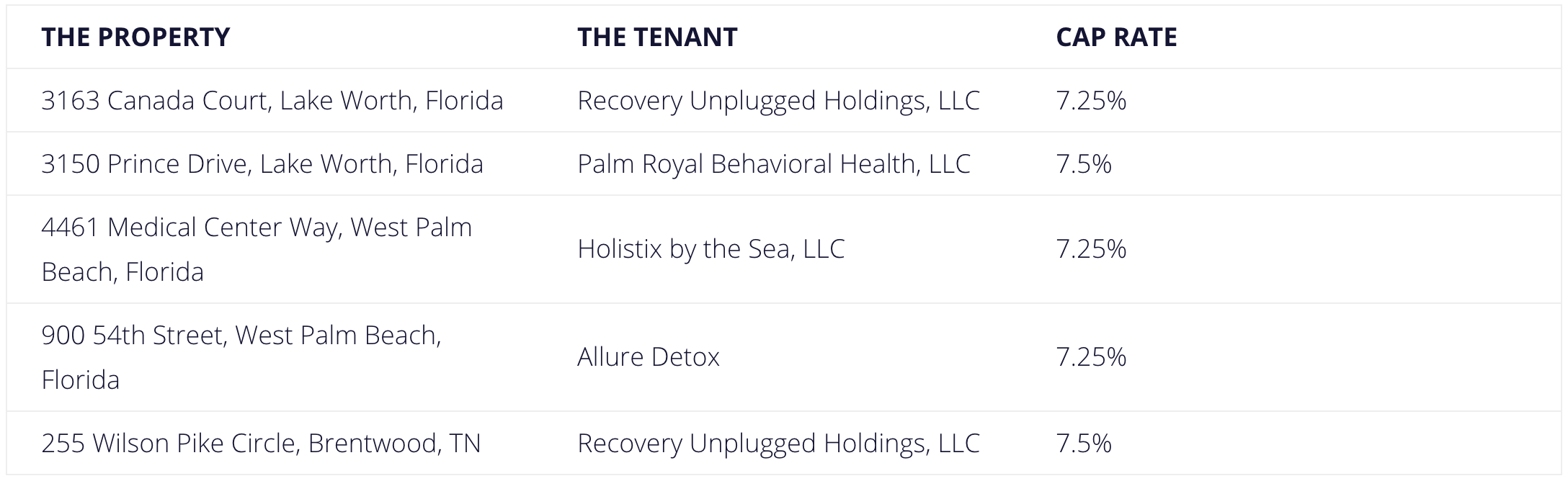

ACQUIRED PROPERTIES

INVEST IN TOKENIZED PROPERTIES

THE NEXT GENERATION OF VENTURE FUNDING: POWERED BY THE BLOCKCHAIN

We offer asset-backed security tokens to help security issuers raise more capital and offer investors true liquidity.

We are democratizing real-estate investing!