WHY YOU NEED TO START INVESTING

The single most important investment question you need to ask yourself is, “How long am I investing for?” How you answer it can change your perspective on everything.

— Morgan Housel

What Exactly Is Investing?

Investing is the process of allocating resources with the expectation of generating income or profit in the future. From a strictly financial standpoint, the resource in question is money. This money is typically deployed across various asset classes such as stocks, bonds, and real estate in a bid to build wealth over time.

Savings vs. Investing

Saving is what you do with the money you’re going to use to pay for short-term goals. For this reason, this money will need to be held in a highly liquid and easily accessible deposit account. Due to their risk-free and highly liquid nature, these savings accounts will offer little to no returns, leaving you with negative returns from an inflation-adjusted standpoint.

Investing is what you do with money earmarked for long-term goals like retirement. With a long-time horizon, you can make growth, rather than liquidity, the priority, creating the opportunity to avail of positive returns over time.

Why Should You Invest?

The two leading ways an individual may generate money is by earning an income or by growing your assets through investments. You work hard for your money, but with saving rates now close to zero, the banks aren’t exactly breaking a sweat paying you to keep your money in the vault. As a result, the onus is on you to create an investment plan that will put your money to work.

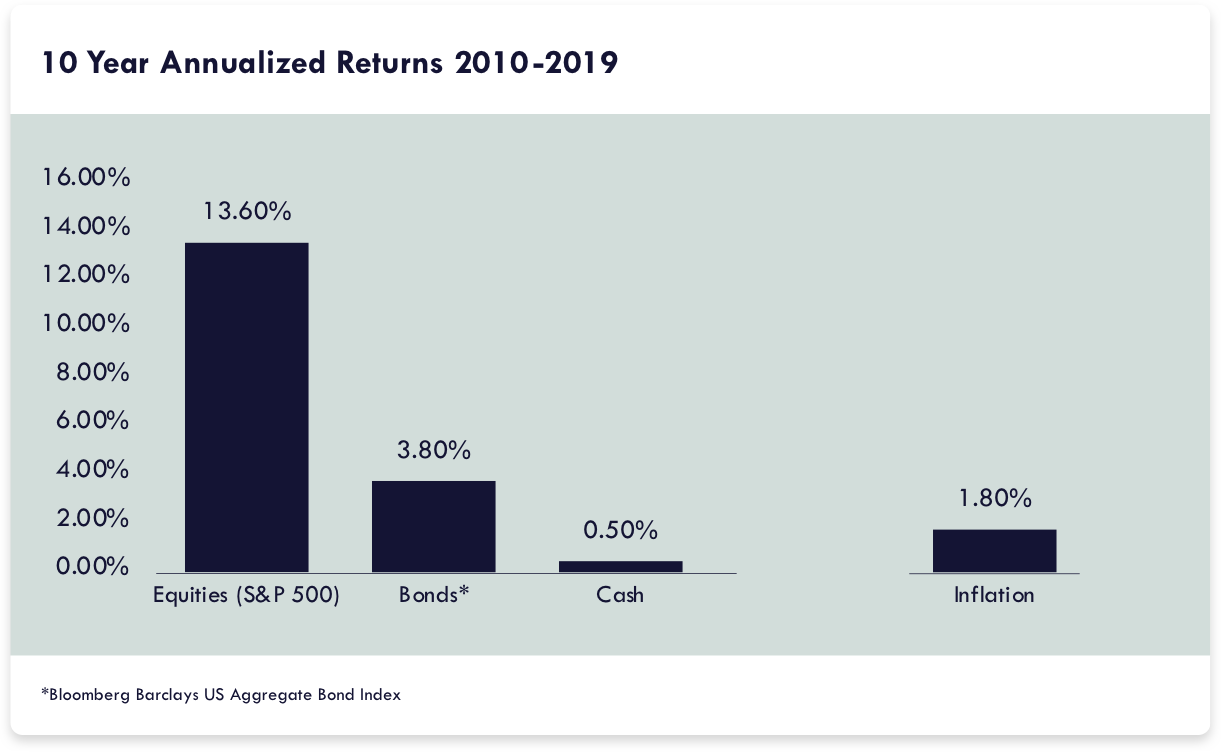

While historical performance is not a guarantee of future performance, it provides an insight into how specific asset classes behave over time and their long-term return potential. Over the last 20 years, for example, all major asset classes have outperformed cash, despite two significant downturns during this 20-year period in the form of the dot com crash and the financial crisis.

Most recently, the Corona Virus pandemic has highlighted the markets enduring ability to recover and adapt. Following the biggest market tumble since 2008, stocks recorded from their march lows, to reach all time highs just six months later, fastest rebound in history.

Inflation – The Silent Thief

Investing has become even more paramount in recent years as historically low interest rates have ensured that savings accounts return negative real returns after inflation, making it possible to save money and lose money — that is, spending power, at the same time.

Inflation refers to the increase in the price of goods and services in the economy. As the prices you pay for these goods increase, the corresponding value of your money decreases. Put another way, as inflation increases over time, you will need more money to buy the same quantity of goods and services. This decrease in purchasing power can have a precipitous and negatively compounding effect on your wealth, especially given the historically low interest rates currently on offer. In nominal terms, a banks savings account may offer you an interest rate of 0.5%, but at an inflation rate of 2%, the real return (the return once inflation has been accounted for) is – 1.5%. Your balance might be increasing, but not enough to keep up with higher prices.

To understand the longer-term effects of inflation, consider the following example of the purchasing power of $10,000 in 1971, compared to today.

According to the Bureau of Labor Statistics consumer price index, prices in 2020 were more than 550% higher than prices in 1971. In other words, if you put $10,000 under your mattress in 1971, it would have the equivalent purchasing power of about $1,800 by today’s standards. Granted, there have been some large-scale inflation fluctuations over this period, but the compounding effects are no less apparent. So, while a -1.5% return may seem justifiable in the short term, it can have detrimental effects on your money over time.

Do you tell yourself you’ll invest when you make more money or that you’ll get around to it “someday”? Or maybe you’re worried the markets are looking a little shaky at the moment, so you’re sitting on the sidelines, waiting for a “better time” to take the plunge.

For those using these excuses or who say, “I can’t afford to start investing.” The truth is, you can’t afford not to start investing because time is the issue here, not money. Time in the market is far more important than timing the market. Compound interest is the real silver bullet when it comes to growing your wealth, and the earlier you start, the more powerful it becomes.

The Wonders Of Compounding

Time exerts the greatest influence on your investment portfolio. Through the power of compounding, a small amount of money over time can grow into a substantial sum. Within financial circles, compounding is often referred to as ‘magic’ or ‘an investor’s best friend‘, while Alfred Einstein once described compound interest as the most powerful force in the universe.

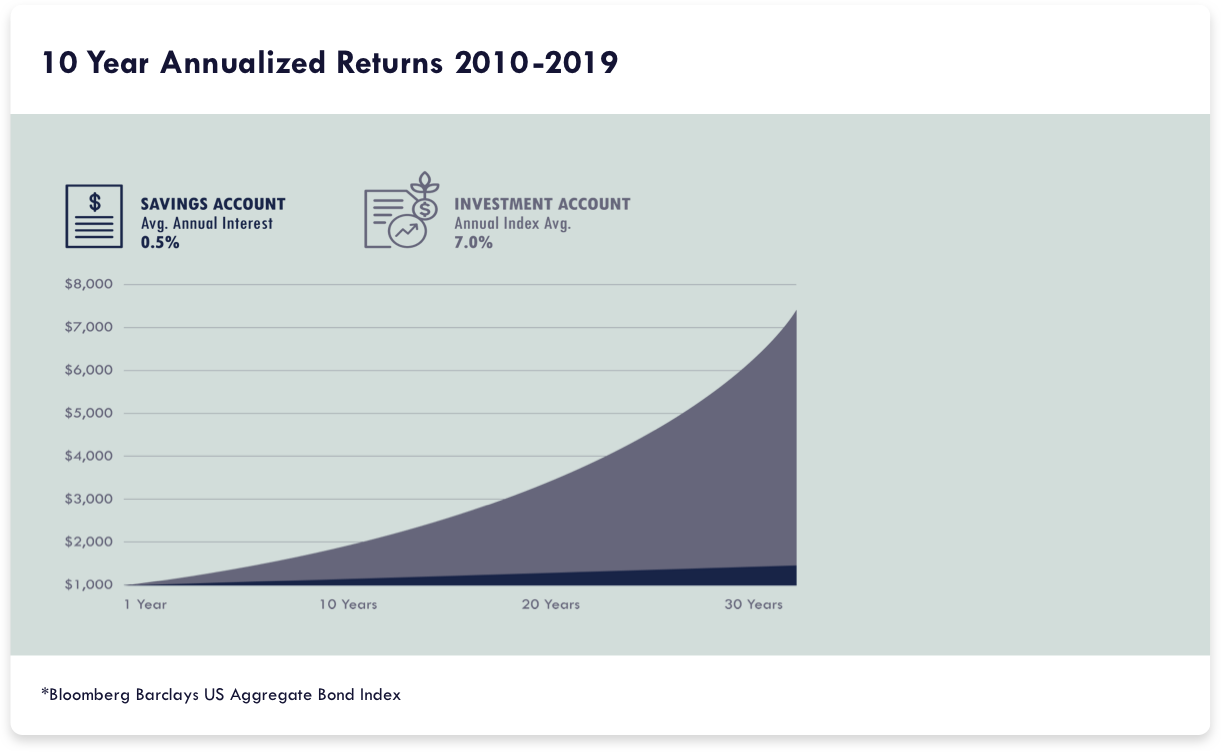

Compounding is simply when the returns you earn on your investment start to make returns, creating exponential growth over time. We can sometimes struggle to comprehend the power of compounding as we tend to think of growth in arithmetic as opposed to geometric terms. Taking the below example tracking the return of a single $1,000 investment over 30 years, you can expect to earn over 40 times more from your investment account.

The sheer power of compounding should add a sense of urgency to everyone’s investment plan regardless of your financial goals. If you wait just six years to get started and your assets grow at 12% annually, you will have half as much money when you retire compared to starting today. That’s a life-changing difference in net worth for just a little procrastination.

Risky Business

Even though investing can generate attractive returns, it is not without risk. The biggest risk with investing is that you may lose the money you invest. In contrast, your savings account is typically guaranteed by the FDIC.

That being said, there are simple steps you can put in place to mitigate these risks, such as diversification and managing your time horizon (we will go into more detail on these approaches in later chapters).

Certain investments are less risky than others, but all investments carry some level of risk. The returns that you earn are a direct result of the risks you take.

For someone to take on a lot of risk, there must also be the possibility of great reward. Conversely, investments with less risk typically have lower returns.

Start Small But Start Now

You don’t need to make a huge decision regarding your life-savings all at once. Start small but start now. After that first step, it all gets a little easier.

They say the price of inaction is far greater than the cost of making a mistake. This is especially true for so many investors. People who are paralyzed by indecisions or the fear of making a mistake subsequently do nothing and miss out on a multitude of opportunities in the process.

This is a very understandable, albeit irrational, fear. Statistically speaking, the broad equity market has continued to reach higher and higher valuations since inception, so the probability of success rests firmly in the investor’s favour. Just to reiterate, as I feel it is a point worth repeating; On average, the stock market has returned roughly 10% annually since 1974 (without factoring in inflation). A far more enticing return than the pennies on offer in your savings account.

Of course, it is not as easy as just throwing your money into the stock market and coming back in 20 years to collect your winnings. But by taking steps to put a well thought out and diversified investment plan in place, you can mitigate much of your risk and expose yourself to longterm positive returns that will continue to compound over time.